Credit Repair in Action

Partnership that is really helping.

We all have had an outrageous 2 plus years, and some of us did what we needed to do to get by, perhaps choosing some finance options that were not in our interest. We see so many families and clients of our referrers, go down the Pay-Day Loans and other gimmicky finance with high interest & fees.

The biggest effect we are seeing on Credit Score positions, is actually applying multiple times and affectively negatively impacting the number above.

With our new partnership we are already seeing results for our clients. That is why this month our focus is on improving customers credit scores to allow them to borrow (as needed) the right types of loans that will positively affect their lives.

May is the month for clients to think about: CREDIT REPAIR SOLUTIONS

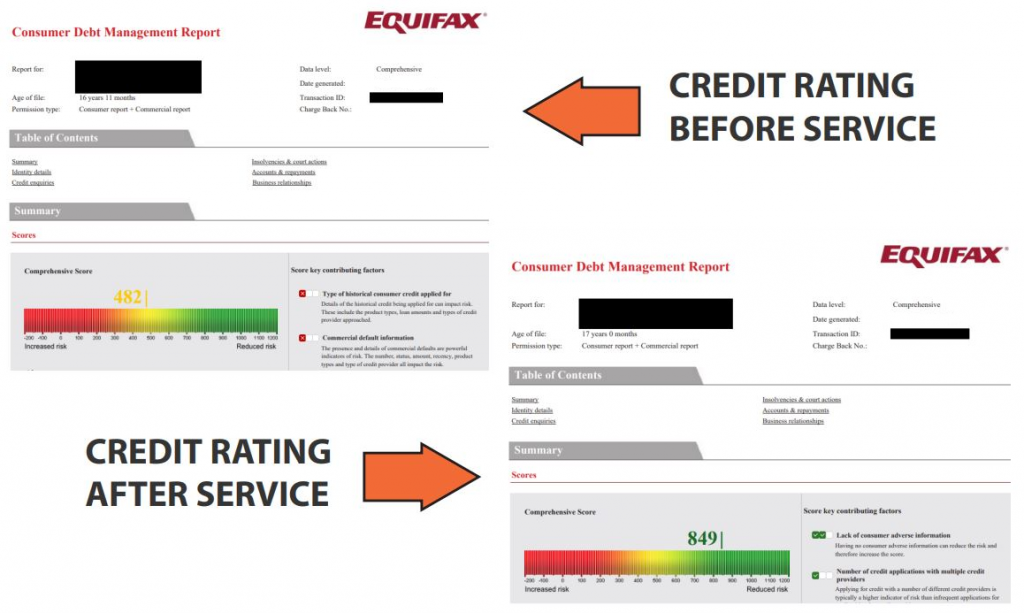

We have had one of our referrers introduce us to their client who had difficulties based on their credit score to get a loan. We introduced our credit repair solutions partner and here is their story.

We can help.

With a recent credit score check the customer report came back with a score of 385, as you can see from the scale below, it sat in the red, below average or poor.

Scenario

Referred from one of our brokers who sent us their clients’ details below.

Colin from Aspley, QLD didn’t realise he had a telco default, he was declined by the banks and had to use payday loans (the only ones that would accept him) this caused his credit score to downward spiral.

Our credit repair partners took the file and started their process, they were able to get his default removed as well as working on getting all the credit enquiries removed from when he was declined.

From the graphic above, you can see that our partners were able to get Colin’s credit score from 482 up to 849 with approximately one month between reports. By understanding his position, they were able to negotiate to remove the telco default (which he didn’t even know he had ~ like so many others don’t) and get the ball rolling to fixing the credit score – a credit score of 849 enabled him to get access to some of the best options on the market for finance.

Now Colin is in a better situation ~ which allowed him to get approve for consolidation loan to fix the damage he had caused to his financial situation.

We were able to get him a total loan of $28,000.

What we needed from them was the following:

– Driver Licence front and back

– Last 2 payslips for both applicants

– Bank Statements and Credit Card Statements

– Current Assets and Liabilities

We provide upfront quotes and the customers were happy to proceed with the loan offer. The transaction took 2 days from start to finish and we were able to continue our success by paying the referrer within 24 hours of settlement.

You can see how you can help your clients and clients clients with credit repair solutions – don’t continue to do applications / credit enquires with lenders.

We can help!

With a simple referral to LendConnect so send us your scenarios OR send your clients’ details and we’ll do the rest!

Referral Fee paid in 24 hours.

We continue to be different

As an award winning diversification business, our focus is helping your clients transact these loans, so you can focus on the bigger home loan business that you and your team are best known for. If you think we can make a difference, reach out to us below.

What makes us different from the rest: –

We are hands on with our clients and our partner’s clients and

At any time you can connect with LendConnect and it’s directors via email or phone.

Contact us Now : Phone: 1300 125 363 or Email: [email protected]